Analyses

The future of Ethereum – what’s next?

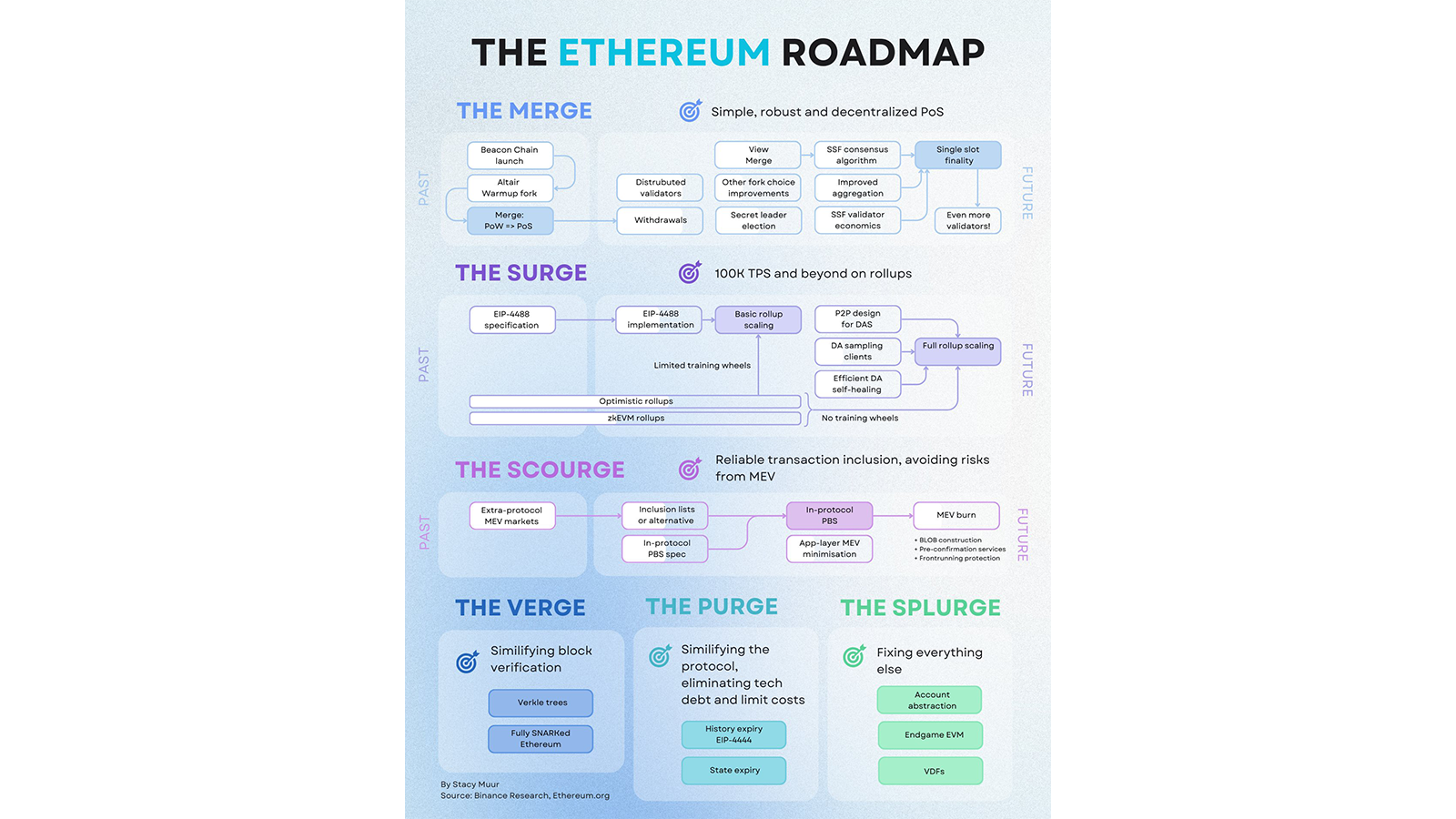

The Ethereum roadmap outlines a strategic plan to address key issues such as high gas prices, security and privacy concerns, and centralisation. It aims to implement rollup-oriented scaling, improve privacy and simplify the protocol in several stages.

By leveraging innovative solutions such as L2 rollups and smart contract wallets, Ethereum aims to achieve global scalability and become a powerful decentralized world computer that enables widespread adoption and revolutionizes different industries.

With the completion of “The Merge”, Ethereum (ETH) is preparing for its next major upgrade, dubbed “The Surge”. The plan is designed to address the widely debated issue of high gas prices.

So, what’s on Ethereum’s agenda?

Ethereum roadmap: Merge, Surge, Scourge, Verge, Purge and Splurge

According to Ethereum’s co-founder Vitalik Buterin, the Ethereum roadmap is divided into several phases, and these development phases are being developed in parallel (the diagram above shows the process).

Phases of the development

- The Merge: Moving to PoS (proof-of-stake) consensus. Develop a robust, fault-tolerant, scalable proof-of-stake solution.

- The Surge: Rollup-centric scaling to 100,000+ transactions per second

- The Scourge: Avoiding centralisation and other protocol risks of maximum recoverable value (MEV).

- The Verge: Block checking to make it “super simple”. ZK based Ethereum core network.

- The Purge: Simplifying the protocol and reducing the operational cost of network nodes. Introducing the ability to discard transaction history and other “redundant” data.

- The Splurge: “Fixing everything else”. E.g.: achieving zkEVM final state, protocol-based account abstraction, etc.

How will Ethereum reach global scale?

Ethereum is working to provide an open and permissionless experience for the myriad of decentralized applications (dApps) built on it. These applications range from crypto brokers to digital collection stores to real-asset tokenization platforms and data platforms.

Buterin listed three important technical transitions that Ethereum needs to undergo to become a global phenomenon.

- Scaling through rollups

Ethereum’s strategy is to achieve global scale through roll-ups. A rollup is a second layer (Layer-2) chain that exists ‘on top’ of a primary blockchain network (Layer-1). These rollups process transactions on the L2 chain, aggregate them and publish the bundled transactions on the L1 chain. The roll-up groups the transactions into groups so that no transaction fee (gas) is charged for each transaction.

Gas fees on Ethereum are notoriously high, often in the range of $3 to $4 under normal circumstances. However, there have been occasions when the network has become overloaded and ETH gas fees have soared to over several hundred dollars. These excessively high fees are a significant barrier to the overall adoption of Ethereum (as a minor digression, the high gas fees reflect the network’s built-in defense mechanism – “it’s a feature, not a bug” )

- Smart contract wallets

Wallets are the gateway to the world of crypto and Web3. However, the adoption of crypto wallets is hampered by cumbersome entry processes. The crypto industry has also been plagued by hacks and thefts of mismanaged wallets, with users losing thousands of dollars in crypto or NFT.

In the upcoming Ethereum updates, developers plan to introduce smart-wallets. Onboarding and account resetting are expected to become smoother, and transferring crypto between different networks is expected to be easier.

- Data protection transition

Ethereum will continue to be a strong advocate of user privacy. The roadmap will include updates aimed at ensuring “privacy-preserving money transfers”. Buterin hinted at a future where users move from one address per chain to one address per transaction. However, this is music for the distant future, because of the complexities involved.

Summary: Completed merger and Shanghai updates

Ethereum completed the long-awaited transition from proof-of-work (PoW) to proof-of-stake (PoS) in 2022.

In the first half of 2023, the Shanghai (also known as Capella) upgrade was made live. The upgrade allowed ETH deposited to be removed from staking. Staking is now less risky as ETH tokens are not locked up and can be withdrawn at will.

What else has Ethereum achieved with the Merge?

- It marked the start of Ethereum’s multi-phase scaling roadmap;

- Increased decentralisation by lowering the barrier to entry for transaction verifiers and block-creators;

- Added crypto-economic security to the protocol through penalties (e.g. slashing);

- Reduced energy consumption by 99%;

- Reduced the supply of ETH in circulation by introducing staking.

Next step in the Ethereum roadmap: the Surge

Let’s focus on the most immediate step in the roadmap, The Surge, which will focus on scaling Ethereum by making gas fees cheaper.

Previously, developers had considered sharding as a possible way to scale Ethereum.

Sharding is a way of splitting the Ethereum blockchain into multiple chains so that subsets of validators are only responsible for processing a fraction of the total amount of data at a time.

However, according to the updated roadmap, a more efficient way of scaling Ethereum is L2 rollup. This is where EIP-4844 comes in.

EIP-4844: Proto-Danksharding

EIP-4844 is also known as proto-Danksharding. The upcoming Ethereum update will introduce a new way for rollups to add cheaper data to blocks.

It should be noted that L2 rollups such as Optimism and Arbitrium have reduced gas charges on Ethereum. However, it is not uncommon for these rollups to have gas fees of over $1 per transaction. The developers want to make Ethereum rollup gas fees “as cheap as possible for users”.

Proto-Danksharding will introduce temporary data blobs in each block, allowing rollups to process transactions more cheaply.

As we’ve learned before, rollups batch transactions off-chain and then upload them in compressed form to Ethereum to reduce the gas fee paid for each transaction. To prevent fraudulent activity, rollup transaction data should be available to honest actors to verify that the transaction status is correct. However, transaction history does not have to be available forever. They can be discarded after the verification is complete.

According to the Ethereum blog:

“Currently, rollups are limited in how much they can make user transactions cheaper by publishing transactions in CALLDATA. This is expensive because the information is processed by all Ethereum nodes and is stored forever as part of the network, even if rollups only need this data for a short period of time.”

The temporary data blobs introduced by proto-Danksharding will only store the history of roll-up transactions for a limited period of time (1-3 months), after which they will be automatically deleted. The “prover” will have to attack all fraudulent transactions within this time interval.

In addition, data stored in temporary data blobs will not be accessible by the Ethereum Virtual Machine (EVM). This means that the EVM will store and process less data, resulting in lower gas prices. Buterin says Ethereum developers will also look to community projects to store the full history of rollup transaction data.

Proto-Danksharding is just a stepping stone to the ultimate solution – Danksharding.

Think of Danksharding as Proto-Danksharding at a higher level. The number of temporary data blocks in proto-Danksharding increases from 1 per block in Danksharding to 64 per block in Danksharding.

However, to reach this level, Ethereum will need to make a number of improvements. According to Ethereum’s website, Danksharding is “several years away”, while proto-Danksharding “could arrive relatively soon”.

Ethereum roadmap: a long road ahead

If we learned anything from The Merge, it’s that Ethereum updates tend to take longer than expected. This is due to the painstaking testing and planning that developers run to make updates as smooth as possible. Billions of dollars and millions of users’ wealth are at stake.

The road ahead will be no different. Most of these upgrades have no blueprints because they have never been done before, never implemented. As we have become accustomed to, it is often the Ethereum developers who develop and test new solutions for the future, which are then used by the “Ethereum killer” projects a few years later.

In his blog post on the Ethereum roadmap, Buterin described the road ahead as a major challenge and called for “intense coordination”. Listing L2 scaling, smart wallet migration and privacy migration as long-term goals for Ethereum, Buterin explained:

“It’s not just the functionality of the protocol that needs to be improved; in some cases, the way we interact with Ethereum will need to change quite fundamentally, requiring profound changes from applications and wallets.”

The bottom line is that there is optimism and optimism in the Ethereum community. The 2022 “event-free” merger highlighted the efficiency of the Ethereum developers’ work, given how smoothly Ethereum’s biggest update to date went.

Let’s hope that the next steps are moving towards the goal with such certainty, and as we can already see, this is being appreciated by the more serious investor groups, as the largest financial firms are also looking at Ethereum.

As was revealed not so long ago, Grayscale already owns $5 billion and Robinhood $2.5 billion in ETH, but we can expect to see numbers and plans from the other major investment funds soon, as they have been looking at Ethereum for years and have been filing spot ETH ETFs in a row to promote it. The road is long, but it has to be done right once.