Analyses

American mining revolution: The revival of mineral resources

April 9, 2024

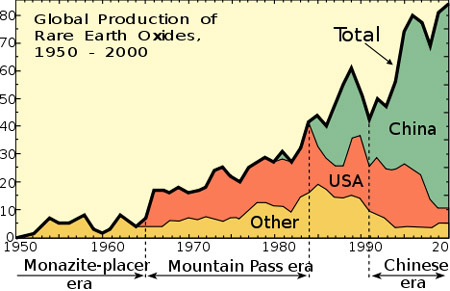

According to Carlos De Alba, analyst at Morgan Stanley, the US metals and mining sector has an optimistic outlook, particularly in terms of the industry’s preparation for huge investments. The US government has already identified critical minerals that are key to the country’s economy and national security. Investment in the industry has been at a low point in recent decades, increasing the country’s dependence on imported minerals, particularly from China.

The analyst points out that China’s global dominance in rare earths poses a national security risk to the United States. Government policymakers need to focus on the country’s mineral dependence and supply chain vulnerabilities, especially at a time of Sino-US tensions.

The US government and industry players are initiating political and economic reforms to revitalise the US mining and separation sector. U.S. permitting reform and government incentives are helping to spur the development of new mining projects and the growth of the domestic mining industry.

Important companies:

- MP Materials:

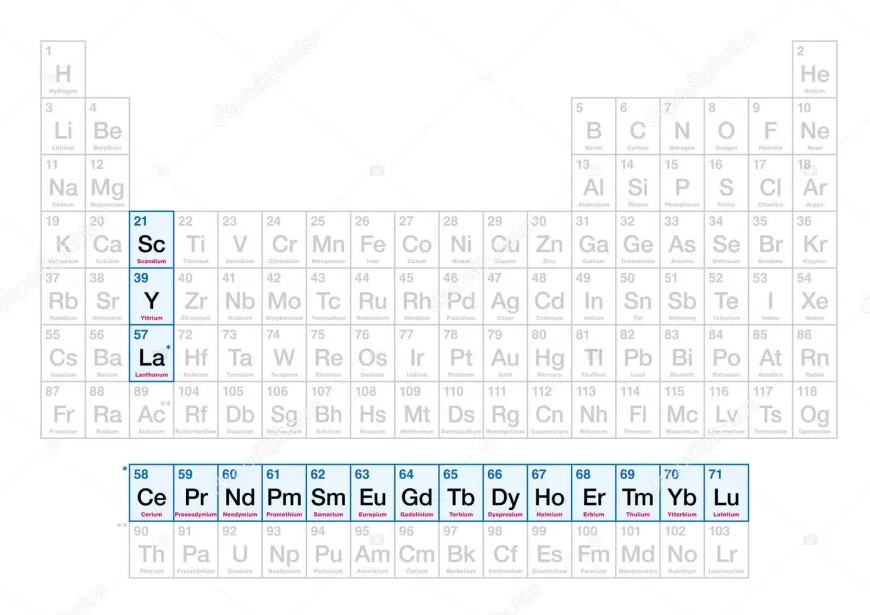

- Focus: rare earth metals

- Plan: Restoring the US rare earth supply chain, including NdFeB alloy.

- American Rare Earths Ltd (ARR.AX):

- Focus: Rare Earths

- Project: Halleck Creek deposit, Wyoming – potentially one of the largest rare earth deposits in the United States.

- USA Rare Earth (private):

- Focus: Rare Earths

- Project: Round Top property in Texas – planned magnet production and rare earth element mining.

- Perpetua Resources (PPTA.TO):

- Focus: Antimony

- Project: Stibnite Gold Project in Idaho – has large economic reserves of antimony that could meet a significant portion of demand in the United States.

- IperionX Ltd (IPX.AX, IPX.O):

- Focus: titanium and rare earths

- Project: Titanium Project in Tennessee – extraction of titanium minerals and production of titanium alloys